这星期 Nvidia 将替代 Intel 成为道琼斯指数成份股。乍一看,这将利好 Nvidia。但老子说过:“祸兮福所倚,福兮祸所伏。”

经济学教授 Gary Smith 和他的学生系统分析了道琼斯成份股 1928 年至2006年的数据。他们发现,替代发生之后,那些被踢出道琼斯的股票比替代股的年平均回报率要高出4个百分点!这就是所谓的 “道之诅咒。” 一个典型的例子就是2018年 Walgreens 取代 GE 成为道琼斯的成份股。Smith 教授写他的文章时 (链接见下面) GE 刚被踢出道琼斯,从那至今 Walgreens 跌了将近90% 而 GE 涨了约230%! 这完美验证了 Smith 教授的“道之诅咒。”

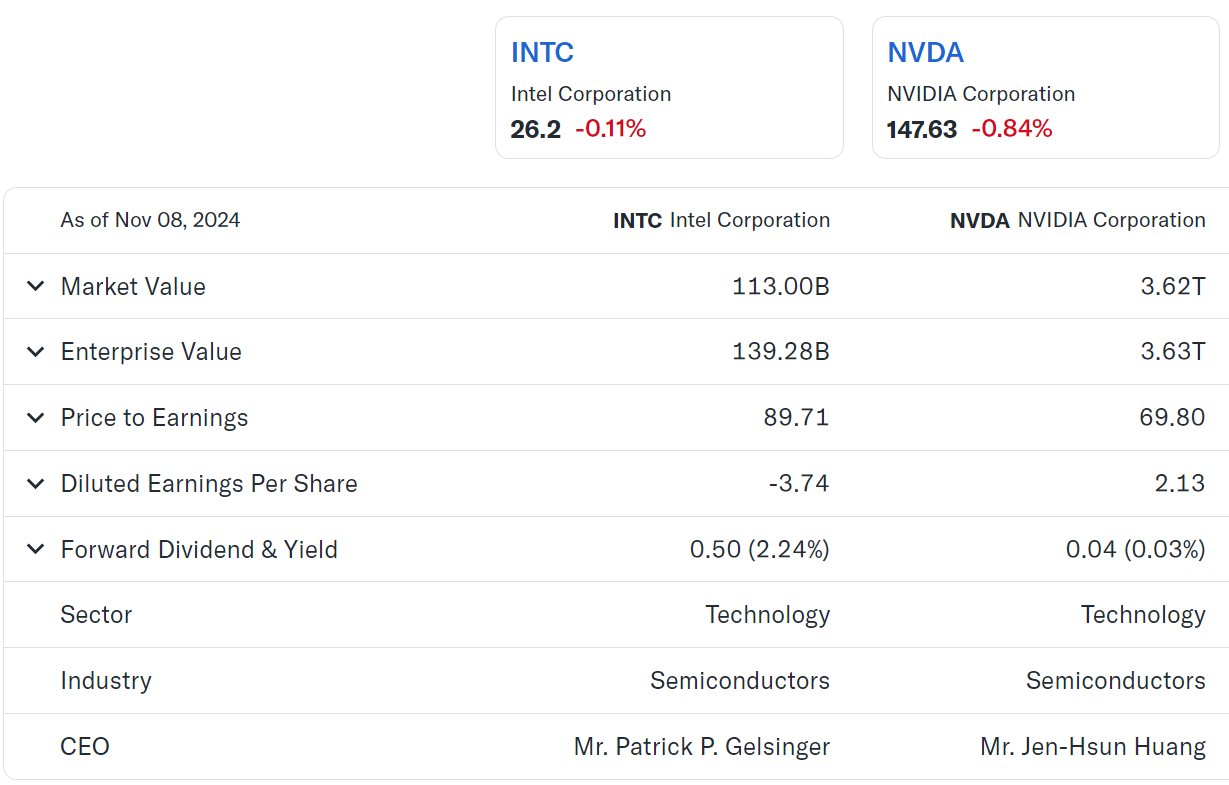

根据 “道之诅咒”的历史规律,持有的 Nvidia 是不是应该换成 Intel ?再加上美国政府大力扶持本国企业、强调本土制造, Intel 很可能会凤凰涅槃、再现辉煌。

Gary Smith 教授的原文节选及链接:

A study I did with two of my students a few years ago looked at every change in the Dow DJIA back to October 1, 1928, when the Dow expanded to 30 stocks. We compared the performance of an Addition portfolio, consisting of stocks added to the Dow over the years, with the performance of a Deletion portfolio, consisting of the stocks that were replaced. The Deletion portfolio beat the Addition portfolio by about four percentage points a year — a huge difference compounded over decades.

...

If so, stock prices will often be unreasonably low for stocks going out of the Dow and undeservedly high for the stocks replacing them. When a company that is struggling regresses to the mean, its stock price will rise. When a company that is doing spectacularly regresses to the mean, its price will fall. This is why stocks booted out of the Dow so often outperform the stocks that replace them — the Curse of the Dow.