刚才在隔壁 newmitbbs 看到关于传奇人物卡尔·伊坎 (Carl Icahn) 名下的上市公司 - Icahn Enterprises L.P. (IEP)。https://newmitbbs.com/viewtopic.php?t=822256

我知道这个人,但今天第一次听说他的公司。在雅虎财经上查看该公司。不看不知道,一看吓一跳。该公司的分红这么高哇!那还不是闭着眼睛买?趁它现在股价低,赶紧捡点儿便宜货。

等等,什么地方不对劲儿。让俺来问问 AI。AI 回答说:

Deciding whether to invest in Icahn Enterprises L.P. (IEP) involves weighing several factors based on available information, including its performance, structure, and risks. Below is a balanced analysis to help you evaluate if IEP is worth investing in, based on its characteristics and sentiment from posts on X, while acknowledging the limitations of the data.

Overview of IEP

Icahn Enterprises L.P. is a diversified holding company managed by activist investor Carl Icahn, with investments in sectors like energy, automotive, real estate, and more. It is structured as a master limited partnership (MLP), which often appeals to investors seeking high dividend yields. However, its performance and valuation have raised concerns, as highlighted by various sources.

Key Points to Consider

1. High Dividend Yield

- IEP offers a high dividend yield, recently reported at around 31.72% to 33.66% based on posts on X.

- This yield implies that an investment could theoretically recover its initial cost in about three years if dividends remain consistent. However, high yields can signal risk, especially if the dividend is unsustainable.

2. Valuation Concerns

- Posts on X from 2023 suggest IEP trades at a significant premium to its Net Asset Value (NAV), with one estimate indicating a 218% premium, far higher than comparable companies.

- There are allegations of inflated valuations for IEP’s less liquid assets, which could exaggerate its reported value.

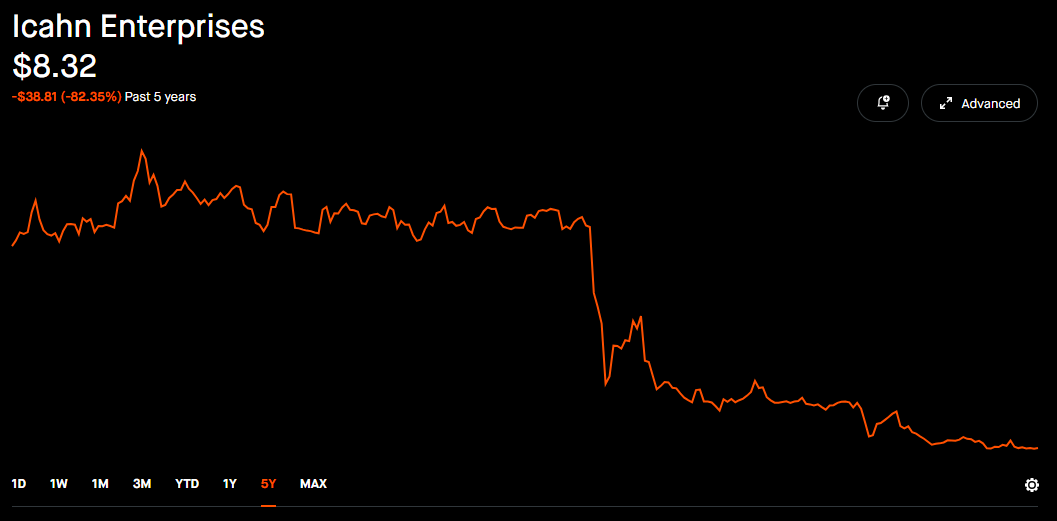

- The stock has experienced significant declines, with one post noting a 54% monthly loss in May 2023 and a drop to its lowest level since January 2000 by April 2025.

3. Performance and Cash Flow Issues

- IEP’s investment portfolio has reportedly lost ~ 53% of its value since 2014, and the company has burned approximately $4.9 billion in free cash flow over the same period.

- The dividend appears unsupported by cash flow or investment performance, raising questions about its sustainability.

- Year-to-date losses following its last disclosure in 2023 further highlight performance challenges.

4. Carl Icahn’s Influence

- IEP’s appeal is partly tied to Carl Icahn’s reputation as a Wall Street legend. However, posts on X question why Icahn has not purchased shares at recent low prices, suggesting potential lack of confidence or strategic considerations.

- The company faced a “short and distort” campaign, as noted in a 2024 post, which may have contributed to its price volatility.

5. Market Sentiment on X

- Sentiment on X is mixed. Some users view IEP as a potential “buy-the-dip” opportunity due to its high yield and Icahn’s historical success, with speculation it could return to a $50 share price with reinstated dividends.

- Others express skepticism, describing IEP as a “crumbling empire” and questioning its long-term viability given its consistent downward trend.

- These posts reflect retail investor perspectives but are not conclusive evidence and should be treated as anecdotal sentiment.

6. Risks

- Dividend Sustainability: The high yield is attractive, but negative cash flow and portfolio losses raise concerns about whether dividends can be maintained without depleting capital.

- Market and Structural Risks: As an MLP, IEP has complex tax implications (e.g., K-1 forms) and is subject to market volatility, particularly in its diverse holdings.

- Activist Strategy Risks: Icahn’s activist approach can lead to volatile returns, depending on the success of his interventions in portfolio companies.

- Liquidity and Transparency: Allegations of inflated asset values and limited institutional ownership (noted in 2023 posts) suggest potential transparency issues.

7. Potential Upsides

- If Icahn’s strategies succeed, IEP could benefit from turnarounds in its holdings, potentially driving share price appreciation.

- The high dividend yield could provide significant income for risk-tolerant investors, assuming it remains intact.

- A recovery to historical price levels (e.g., $50, as speculated) would offer substantial capital gains from current levels.

Analysis

IEP may appeal to investors comfortable with high-risk, high-reward opportunities, particularly those who trust Carl Icahn’s ability to generate value through activism. The high dividend yield is a draw, but its sustainability is questionable given reported cash flow issues and portfolio losses. The significant premium to NAV and allegations of inflated asset values add further risk, as does the stock’s recent poor performance.

For conservative investors, IEP’s volatility, structural complexity, and reliance on Icahn’s individual strategy may make it less attractive compared to more diversified or stable investments like broad-market ETFs. The mixed sentiment on X reflects this divide, with some seeing a bargain and others a value trap.

Recommendations

- Do Your Own Research: Review IEP’s financial statements, including cash flow, debt levels, and portfolio performance, via its SEC filings or investor relations website.

- Assess Risk Tolerance: IEP’s high yield and volatility make it suitable for speculative investors, not those seeking stability.

- Consult a Financial Advisor: Given the complexities of MLPs and IEP’s unique risks, professional advice can help align it with your goals.

- Monitor Dividend Sustainability: Watch for updates on IEP’s cash flow and dividend policy, as cuts could impact returns.

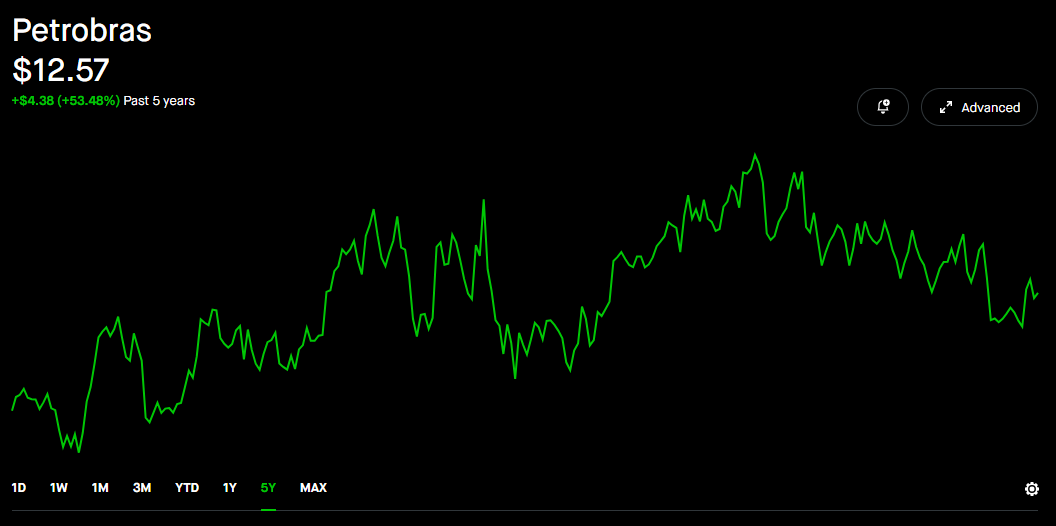

- Consider Alternatives: Compare IEP to diversified ETFs (e.g., iShares Core S&P 500 ETF) or other high-yield investments with lower risk profiles.

Conclusion

IEP is a high-risk investment with potential for significant returns through its dividend and possible price recovery, but it carries substantial downsides due to its valuation, performance issues, and reliance on Carl Icahn’s strategies. Without clear evidence of a turnaround, cautious investors may want to avoid it or limit exposure. Always verify information from X posts and other sources with primary data, as sentiment can be speculative or biased.

读完了 AI 总结俺不敢买了。