下周五又是一个三巫日。大家怎么看?

最近空头被极限打压,会不会借机找存在感?

版主: Nimitz

我替你问了问 AI。AI 总结道:

Triple witching refers to the simultaneous expiration of three types of derivative contracts—stock options, stock index futures, and stock index options—on the third Friday of March, June, September, and December. The next triple witching day in 2025 will be June 20. These events often lead to increased trading volume and market volatility, particularly in the final hour of trading, known as the "triple witching hour" (3:00–4:00 p.m. ET), as traders close, roll over, or offset their positions.Historically, triple witching days have shown mixed market performance.

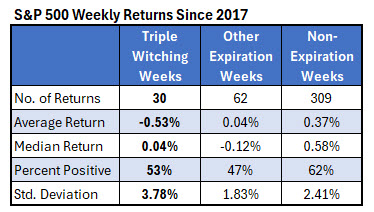

For the S&P 500, data since 2017 indicates an average return of -0.53% during triple witching weeks, compared to +0.37% in non-expiration weeks, suggesting short-term selling pressure. However, some analyses, like one from AInvest, suggest a 60% likelihood of positive returns for major indices on these days, driven by heightened trading activity and potential arbitrage opportunities. For instance, in December 2024, markets ended higher despite volatility, with $4.5 trillion in options expiring.

Individual stocks, like Apple, often see price dips in the days leading up to triple witching (e.g., an average decline of 1.23% two days prior over the past decade), presenting potential buying opportunities for long-term investors. However, volatility can be higher for stocks with lower market capitalization and heavy derivatives activity. Traders may employ strategies like momentum trading, scalping, or pairs trading to capitalize on price swings, but caution is advised due to increased risk.

The finance card above shows the S&P 500 (SPY) at $598.386 on June 12, 2025, with a year-to-date increase from $586.08 in December 2024. While triple witching can amplify volatility, its impact is often short-lived and influenced by broader market conditions, such as economic news or index rebalancing. Investors should monitor market sentiment and use risk management strategies, like smaller position sizes or diversification, to navigate potential price swings.

再转载些具体的数据 (https://www.schaeffersresearch.com/cont ... 20positive.):

POOR PERFORMANCE & TRIPLE WITCHING WEEKS

The S&P 500 has averaged a 0.53% loss during these weeks with 53% of the returns positive. Expiration week in general hasn’t been great with other expiration weeks averaging about a breakeven return with less than half of the returns positive. Market gains have come during non-expiration weeks in which the index has averaged a return of 0.37% return with 62% of the returns positive.

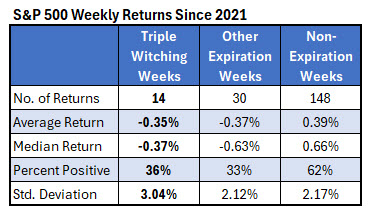

This next table shows more recent data, going back to 2021. Expiration weeks, whether triple witching or not, have been bad for stocks with about 35% of them positive averaging a return of 0.36%. I mentioned above how pundits often say to expect volatility during triple witching weeks. They’ve been right on this. Since 2021, the standard deviation of returns during triple witching week has been 3.04% which is significantly higher than other weeks.

WHERE TRIPLE WITCHING DAYS

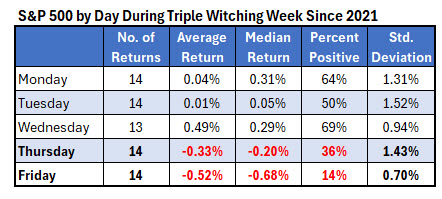

The table below summarizes triple witching week by day since 2021. These weeks tend to be fine through the first half of the week, then Thursday things start to unravel. In the 14 triple witching weeks since 2021, the S&P 500 has averaged a loss of 0.33% on Thursdays with just 36% of those returns being positive. If that’s not bad enough, triple witching day, which is the actual day of expiration, the index has averaged a loss of 0.52% with just two of the 14 days positive. For whatever reason, investors have tended to sell during triple witching week and especially at the end of the week.

One thing I find interesting in the table below is that triple witching day, Friday, has the lowest standard deviation of returns. Poor stock returns are typically accompanied by higher volatility but in the case of triple witching days since 2021, the returns have been consistently bad with little deviation.

最后一个图的红色部分数据,颜色效果非常好。

VIX 又出机会。

上周五最后买 SVIX 可能是个败笔,got carried away 惭愧

Who Are You?

https://www.nyse.com/markets/hours-calendars

All NYSE markets observe U.S. holidays as listed below

Juneteenth National Independence Day Thursday, June 19, 2025

又少了一天,周五要一天当两天了

Who Are You?