喊“美国制造”却将产线移中国 特朗普金主保尔森关俄州厂

https://m.wenxuecity.com/news/2026/02/18/126538643.html

给川普捐款5000万的美国制造捍卫者,今年关厂转移到中国

版主: who

Re: 给川普捐款5000万的美国制造捍卫者,今年关厂转移到中国

UAW工会是重要因素。

其实到了自身利益的时候才是反映一个人到底怎样的节点。

这个和当年美国汽车和日本竞争一样。

你怎么不说工会是毒瘤呢?

摸摸头

Re: 给川普捐款5000万的美国制造捍卫者,今年关厂转移到中国

没工会,红脖子也不要制造业回归了,还不如去麦当劳翻肉饼

Re: 给川普捐款5000万的美国制造捍卫者,今年关厂转移到中国

LOL,那为啥工会在那里100年了、今年不行了?

Re: 给川普捐款5000万的美国制造捍卫者,今年关厂转移到中国

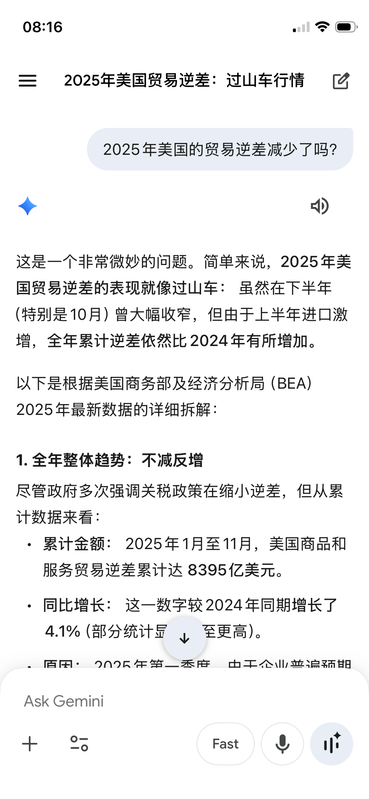

为什么拜登期间每年都增加几十万制造业岗位,老川一上来就开始每年减少几十万工作岗位?

同时财政赤字继续增加1.8万亿,倒是拜登期间2024年减少了400亿,但是这个是在NSF/ NIH科学基金被砍了400多亿,美国企业那里多收了3000多亿关税的前提下

导致的结果是大量小制造企业关闭

2025年美国财政赤字总额约为 1.8 万亿美元(确切数字为 1.775万亿至1.809万亿美元之间,因统计口径略有差异)。

尽管这一数字依然惊人,但与2024财年的1.83万亿美元相比,赤字规模实际上小幅下降了约 2%(约 400 亿美元)。

Re: 给川普捐款5000万的美国制造捍卫者,今年关厂转移到中国

说的对

收起来的关税应该发给中低端制造业、我们又不像高科技没法去股市割韭菜

这个铜管乐器厂,被关税重击,你在美国有铜矿成熟生产、可以收、譬如电车

没有替代品、收关税?这种脑残政策也就川普这个老年痴呆脑子能想出来,周围一批马屁精能跟着拍

至 2026年2月,美国对进口铜及铜制品的关税政策非常严厉且复杂。根据当前的贸易政策,美国主要针对半成品铜和高含铜衍生品征收高额关税,而对原材料则相对宽松。

以下是具体的关税细则:

- 核心关税:50% 额外关税 (Section 232)

Re: 给川普捐款5000万的美国制造捍卫者,今年关厂转移到中国

https://www.investing.com/economic-cale ... -index-236

How to Understand the Feb 2026 Data:

AI Overview

The Philadelphia Fed Manufacturing Index for February 2026 indicates that manufacturing activity in the region expanded, with the main index rising to 16.3. A reading above zero shows growth, meaning the sector grew despite declines in some subcomponents like shipments and employment. It serves as a key indicator of regional economic health, often influencing the U.S. dollar and national economic outlooks.

How to Understand the Feb 2026 Data:

Headline Index (16.3): The index rose from 12.6 in January to 16.3, surpassing expectations and reaching a five-month high, signaling improved business conditions in the third district.

Subcomponents Mixed: While the main index showed expansion, new orders decreased slightly to 11.7, and shipments fell to 0.3, indicating that while activity expanded, some logistical or production areas saw slower activity.

Employment Warning: The employment index slipped into negative territory at -1.3, suggesting a decrease in employee numbers among surveyed firms.

Prices: The prices paid index dropped to 38.9, the lowest since January 2025, hinting at a potential easing of inflation pressures in manufacturing costs.

Future Outlook: The future general activity index rose to 42.8 from 25.5, suggesting manufacturers are optimistic about growth over the next six months.

Significance of the Report

Market Impact: A stronger-than-expected headline figure (16.3 vs. 7.7 estimate) is generally seen as bullish for the U.S. dollar.

Context: The report, covering about 250 manufacturers, provides a monthly glimpse into regional manufacturing, which is often used to predict national trends in the US Economy.

Usage: Investors use this report to gauge the velocity of economic activity and anticipate potential changes in Federal Reserve policy.

养老型发言