这一周太多感兴趣的了。

最近关注 Opendoor,看它能不能摘到毛票股的帽子。

Re: Most anticipated earnings, the week of August 4

Re: Most anticipated earnings, the week of August 4

https://investor.opendoor.com/news-rele ... al-results

Second Quarter 2025 Key Highlights

- Revenue of $1.6 billion, up 4% versus 2Q24 and up 36% versus 1Q25; with 4,299 total homes sold, up 5% versus 2Q24 and up 46% versus 1Q25

- Gross profit of $128 million, versus $129 million in 2Q24 and $99 million in 1Q25; Gross Margin of 8.2%, versus 8.5% in 2Q24 and 8.6% in 1Q25

- Net loss of $(29) million, versus $(92) million in 2Q24 and $(85) million in 1Q25

- Inventory balance of $1.5 billion, representing 4,538 homes, down (32)% versus 2Q24 and down (35)% versus 1Q25

- Purchased 1,757 homes, down (63)% versus 2Q24 and down (51)% versus 1Q25

- Ended the quarter with 393 homes under contract for purchase, down (78)% versus 2Q24 and down (63)% versus 1Q25

Non-GAAP Key Highlights*

- Contribution Profit of $69 million, versus $95 million in 2Q24 and $54 million in 1Q25; Contribution Margin of 4.4%, versus 6.3% in 2Q24 and 4.7% in 1Q25

- Adjusted EBITDA of $23 million, versus $(5) million in 2Q24 and $(30) million in 1Q25; Adjusted EBITDA Margin of 1.5%, versus (0.3)% in 2Q24 and (2.6)% in 1Q25

- Adjusted Net Loss of $(9) million, versus $(31) million in 2Q24 and $(63) million in 1Q25

*See “—Use of Non-GAAP Financial Measures” below for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures.

Third Quarter 2025 Financial Outlook

- 3Q25 revenue guidance of $800 million to $875 million

- 3Q25 Contribution Profit1 guidance of $22 million to $29 million

- 3Q25 Adjusted EBITDA1 guidance of $(28) million to $(21) million

Re: Most anticipated earnings, the week of August 4

好大一条瀑布。 ![]()

spring 写了: ↑05 8月 2025, 15:23https://investor.opendoor.com/news-rele ... al-results

Second Quarter 2025 Key Highlights

- Revenue of $1.6 billion, up 4% versus 2Q24 and up 36% versus 1Q25; with 4,299 total homes sold, up 5% versus 2Q24 and up 46% versus 1Q25

- Gross profit of $128 million, versus $129 million in 2Q24 and $99 million in 1Q25; Gross Margin of 8.2%, versus 8.5% in 2Q24 and 8.6% in 1Q25

- Net loss of $(29) million, versus $(92) million in 2Q24 and $(85) million in 1Q25

- Inventory balance of $1.5 billion, representing 4,538 homes, down (32)% versus 2Q24 and down (35)% versus 1Q25

- Purchased 1,757 homes, down (63)% versus 2Q24 and down (51)% versus 1Q25

- Ended the quarter with 393 homes under contract for purchase, down (78)% versus 2Q24 and down (63)% versus 1Q25

Non-GAAP Key Highlights*

- Contribution Profit of $69 million, versus $95 million in 2Q24 and $54 million in 1Q25; Contribution Margin of 4.4%, versus 6.3% in 2Q24 and 4.7% in 1Q25

- Adjusted EBITDA of $23 million, versus $(5) million in 2Q24 and $(30) million in 1Q25; Adjusted EBITDA Margin of 1.5%, versus (0.3)% in 2Q24 and (2.6)% in 1Q25

- Adjusted Net Loss of $(9) million, versus $(31) million in 2Q24 and $(63) million in 1Q25

*See “—Use of Non-GAAP Financial Measures” below for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures.

Third Quarter 2025 Financial Outlook

- 3Q25 revenue guidance of $800 million to $875 million

- 3Q25 Contribution Profit1 guidance of $22 million to $29 million

- 3Q25 Adjusted EBITDA1 guidance of $(28) million to $(21) million

Re: Most anticipated earnings, the week of August 4

明天不急着接飞刀了

牛大春 写了: ↑05 8月 2025, 16:04好大一条瀑布。

spring 写了: ↑05 8月 2025, 15:23https://investor.opendoor.com/news-rele ... al-results

Second Quarter 2025 Key Highlights

- Revenue of $1.6 billion, up 4% versus 2Q24 and up 36% versus 1Q25; with 4,299 total homes sold, up 5% versus 2Q24 and up 46% versus 1Q25

- Gross profit of $128 million, versus $129 million in 2Q24 and $99 million in 1Q25; Gross Margin of 8.2%, versus 8.5% in 2Q24 and 8.6% in 1Q25

- Net loss of $(29) million, versus $(92) million in 2Q24 and $(85) million in 1Q25

- Inventory balance of $1.5 billion, representing 4,538 homes, down (32)% versus 2Q24 and down (35)% versus 1Q25

- Purchased 1,757 homes, down (63)% versus 2Q24 and down (51)% versus 1Q25

- Ended the quarter with 393 homes under contract for purchase, down (78)% versus 2Q24 and down (63)% versus 1Q25

Non-GAAP Key Highlights*

- Contribution Profit of $69 million, versus $95 million in 2Q24 and $54 million in 1Q25; Contribution Margin of 4.4%, versus 6.3% in 2Q24 and 4.7% in 1Q25

- Adjusted EBITDA of $23 million, versus $(5) million in 2Q24 and $(30) million in 1Q25; Adjusted EBITDA Margin of 1.5%, versus (0.3)% in 2Q24 and (2.6)% in 1Q25

- Adjusted Net Loss of $(9) million, versus $(31) million in 2Q24 and $(63) million in 1Q25

*See “—Use of Non-GAAP Financial Measures” below for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures.

Third Quarter 2025 Financial Outlook

- 3Q25 revenue guidance of $800 million to $875 million

- 3Q25 Contribution Profit1 guidance of $22 million to $29 million

- 3Q25 Adjusted EBITDA1 guidance of $(28) million to $(21) million

Re: Most anticipated earnings, the week of August 4

DUOL

Today: +0.97% +3.30

After Hours: +12.92% +44.40

也是暴涨啊

Re: Most anticipated earnings, the week of August 4

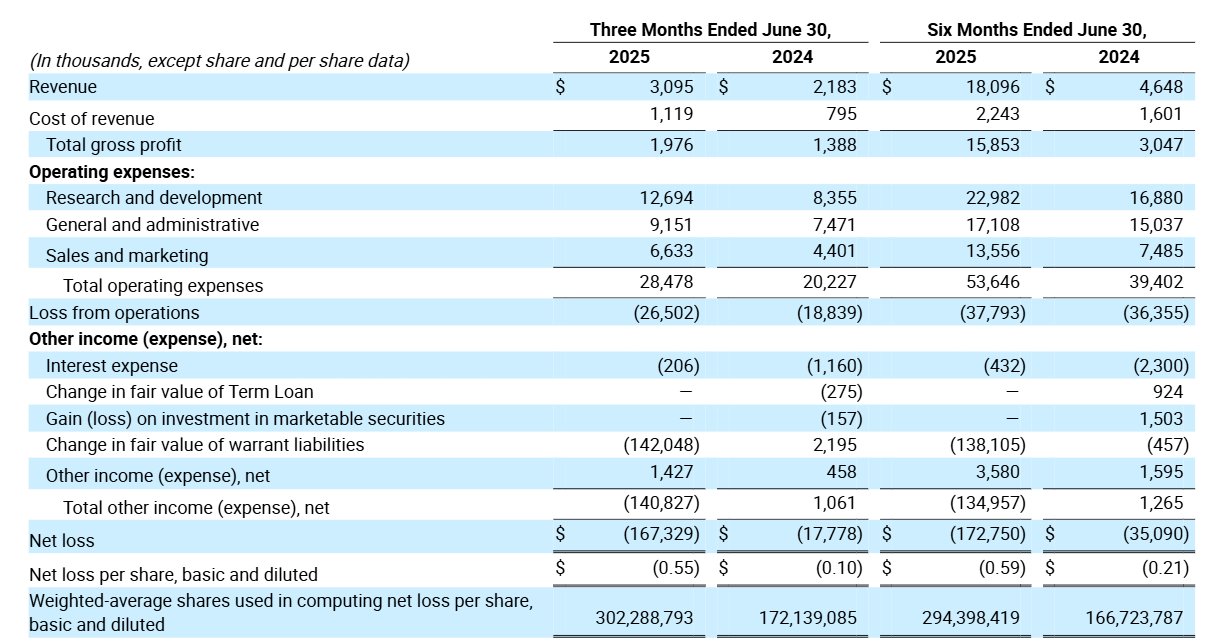

$QBTS

D-Wave

$QBTS Earnings:

- Announced revenue of $3.1 million for the second quarter of fiscal 2025. This is an increase of $0.9 million, or 42%, from revenue of $2.2 million for the second quarter of fiscal 2024.

- Bookings for the second quarter of fiscal 2025 were $1.3 million, an increase of $0.6 million, or 92%, from the fiscal 2024 second quarter Bookings of $0.7 million.

- Adjusted Net Loss for the second quarter of fiscal 2025 was $25.3 million, or $0.08 per share, an increase of $5.3 million, and a decrease of $0.04 per share, from the fiscal 2024 second quarter Adjusted Net Loss of $20.0 million, or $0.12 per share, with the difference between Net Loss and Adjusted Net Loss being non-cash, non-operating warrant remeasurement related charges.

“Our second quarter results show consistently strong performance across a multitude of technical and business metrics,” said Dr. Alan Baratz, CEO of D-Wave. “During the quarter, we brought to market our sixth-generation quantum computer, signed a memorandum of understanding related to the acquisition of an on-premises system in South Korea, completed physical assembly of the previously announced system at Davidson Technologies, introduced a collection of developer tools to advance quantum AI and machine learning innovation, and ended the quarter with a record $819 million in cash. We’re confident in our ability to continue delivering long-term value for our customers, partners and shareholders.”