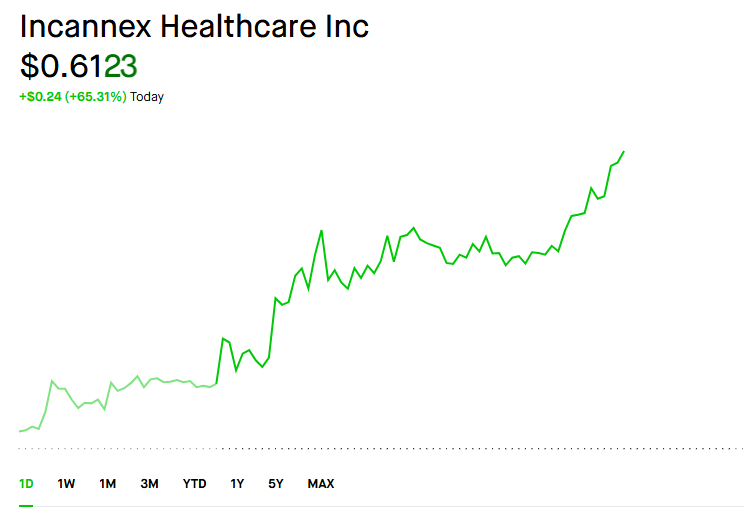

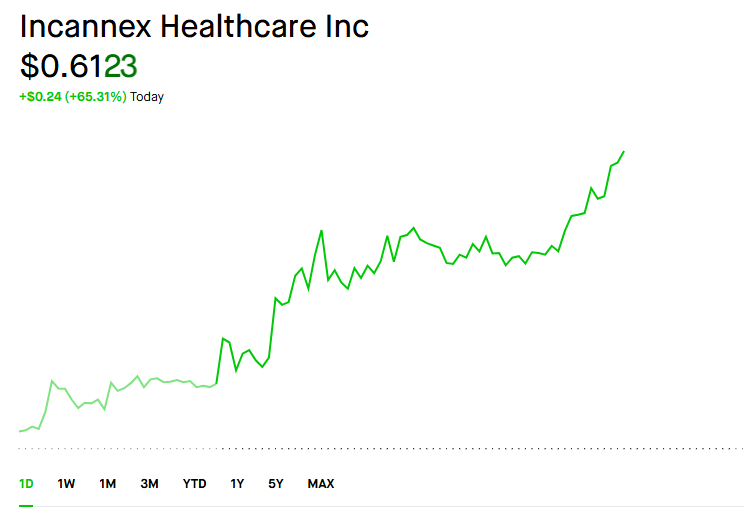

第一次炒毛票

今天早上 1000 * $0.41

计划拿到下周

[非投资建议,清零风险很大]

pink list or over the counter?

Robinhood 上有,没说是啥。

Update: Grok "IXHL is a Pink Sheet stock, traded over the counter."

https://robinhood.com/stocks/IXHL

Margin Maintenance ratio: 100%

Just sold 1000 at $0.64

spring 写了: ↑18 7月 2025, 13:57Robinhood 上有,没说是啥。

Update: Grok "IXHL is a Pink Sheet stock, traded over the counter."https://robinhood.com/stocks/IXHL

Margin Maintenance ratio: 100%

Just sold 1000 at $0.64

一个月前的新闻:

https://ir.incannex.com/news-releases/n ... sa-phase-2

Incannex achieves key milestone with database lock for RePOSA Phase 2 trial of IHL-42X

June 18, 2025

Top-line results expected July 2025 as development of first-in-class OSA drug advances

Joel Latham, President and CEO of Incannex, commented, "Achieving database lock on schedule demonstrates our strong clinical capabilities and commitment to advancing a much-needed therapy for obstructive sleep apnoea. IHL-42X represents a breakthrough opportunity to address a condition affecting hundreds of millions of people globally, with no approved oral pharmacological treatment available. We are excited by what lies ahead."

现在还没有新闻,下周会有更新?如果效果不好,股价要疯狂跳水了

再来一个

SYTA

最近一个月

前半个月暴涨,均线发散,后半个月横盘,均线收敛。很快会再次发散?

Grok. Siyata Mobile Inc. (SYTA)

ABCL

最近一个月

Grok. AbCellera Biologics (ABCL)

HIT

Overview: Health In Tech (Nasdaq: HIT) is an insurtech platform using AI to streamline healthcare processes for small/medium businesses, offering reference-based pricing, group captives, and a SaaS quoting platform.

Key Data (July 2025):

Financials:

Performance:

Catalysts:

Assessment: HIT fits high-volume, low-float penny stock criteria with speculative upside due to AI focus and growth potential. However, regulatory risks and an 82% drop signal high volatility. Suitable for aggressive traders; verify real-time data and allocate minimally.

原来是小药股啊。

以前玩过几个医械股,比如CAMH,不知还在不在了,就是赌FDA Phase III Approval.